Illinois Workers and Families Need Fair Tax Now

Economic equity is the basis of any just society.

Illinoisans cannot reach their full potential without the financial security that allows them to meet their basic needs. Yet the state’s current tax system places a higher burden on middle and lower-income families by taxing everyone at the same rate, regardless of income. But Illinoisans have the opportunity to change the tax system this November.

As it stands, people in the lowest income bracket pay nearly twice as much of their income as the wealthiest pay. As income inequality has soared, this outdated system has resulted in too heavy a burden on working families, and too little tax revenue to fund essentials that help Illinoisans meet their basic needs like education and social services.

Should it pass, the Fair Tax amendment on the upcoming November ballot will eliminate the requirement that all income be taxed at the  same rate. Instead, the wealthiest would finally pay their fair share, while most Illinois residents would see decreases in their taxes.

same rate. Instead, the wealthiest would finally pay their fair share, while most Illinois residents would see decreases in their taxes.

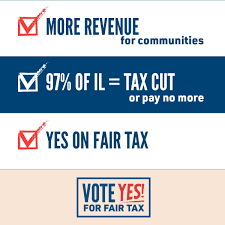

“This November, Vote Yes for Fair Tax so Illinois can ask wealthy people (the top 3%) to pay a little more on income over a quarter-million dollars a year—while everyone else (97% of tax filers) gets a tax cut or pays no more—raising more than $3 billion a year to invest in schools and shared priorities.” – Vote Yes for Fair Tax

A Fair Tax would provide vital funds to the community services that keep Illinoisans healthy and safe, and lift families out of poverty.

Legal Council for Health Justice is proud to stand with more than 115 organizations across Illinois in supporting the Vote Yes for Fair Tax Campaign. This life-changing reform would both ease the financial burden on low-income and middle class families, and raise billions of dollars to fund much-needed expansions and improvements to education and social services across the state.

Illinoisans needs this reform now more than ever. The COVID-19 crisis has exposed how inadequate Illinois’ current tax system is at funding the critical health services we are counting on to protect us, and it unfairly burdens those workers on the frontlines right now—many of whom are Black and Latinx.

It is time for the wealthy to pay their fair share. Here’s how you can join the movement and help all Illinoisans, regardless of their income, reach their full potential:

- Sign this online Pledge Card to Vote Yes for a Fair Tax on the November ballot.

- Watch this video on the Fair Tax and share on your social media.

- Learn how many people in your county will get relief under the Fair Tax.